Payday Loans: Avoid Being Ripped Off!

Payday Loans are a popular way to get cash when you’re short on money.

These small, high-interest loans are typically used to cover an immediate expense and are usually repaid within fourteen days of the borrower’s next payday.

However, they can come with hidden costs and a higher rate of interest than you may be prepared for.

Before you take out a payday loan, you’ll want to check out your options. Local credit unions can offer lower rates than many payday lenders. Alternatively, you can consider an installment loan, which allows you to repay the money in fixed monthly payments.

While payday loans are not for everyone, they can be helpful when used correctly. Some borrowers opt to take out a series of payday loans to pay off their debts, while others take out a single loan to tide them over until their next paycheck. The amount of the loan will also vary from state to state.

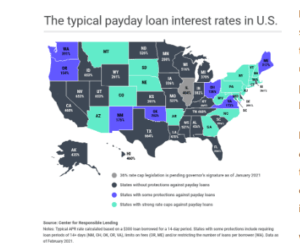

Several states have passed laws that limit the amount of interest you can be charged. For example, in Minnesota, a lender cannot charge a more than $15 fee for every $100 you advance. In addition, some lenders are not required to report the debt to the three major credit bureaus.

Some states have banned payday lending altogether, while others have passed legislation that limits the amount of interest that a borrower can receive. Check with your state’s attorney general to find out if your state has rules in place.

Although there are various types of payday loans available, the average consumer pays about $520 in fees over the course of two weeks. If you need help finding the best options for you, you can contact a community agency or a church. You can also search online to find free, local alternatives to payday loans.

Unlike a traditional mortgage or car loan, a payday loan is a short-term loan that is repaid in one large payment on your next paycheck. Typically, the loan amount is between $500 and $1,500.

Although payday loans are marketed as the solution to your financial woes, they can be a major drain on your finances. They are considered predatory lending by some, and they can even land you in court. Moreover, they can damage your credit score, making them a bad choice for many consumers. To avoid being caught in a debt cycle, you should build a rainy day fund before you use a payday loan.

It is possible to save money by waiting until your next paycheck, but you should always seek the advice of a trusted professional before deciding to take out a payday loan. This can be especially important if you have any credit problems.

Aside from the obvious, you can also seek the assistance of a qualified professional for information about the other payday loan perks that are out there. For instance, you might be able to take out a free payday loan from the Salvation Army or the United Way.

Free Reports:

13 Alternatives To Payday Loans To Get You Cash Quick

Best Quick Loan Options For People With Bad Credit